The posts contain information necessary to build a house and work with contractors.

It is unrealistic to attempt to give give all the information and education required to build your own home in any blog of short posts, week-to- week. This blog can only scratch the surface of tasks and knowledge necessary for the construction of a dwelling.

The author had to write an entire 306 page book to lend credit to the body of knowledge a homebuilder will need to complete the endeavor. Within the book, Working for Subs - How to Build a House and Work with Contractors the reader will find a basic list of tasks in chronological order with expanded explanation of each.

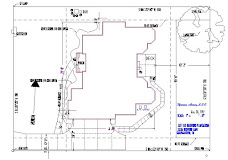

This list of tasks to complete a house is enumerated in the Detailed Schedule found throughout the 19 chapters and totally compiled in one of the 10 appendices. The chapters describe each task in much detail and aid in other areas of construction with photographs, charts, and diagrams.

See other posts following this in the blog for a preview of the book and the Amazon link to it.

Excerpt from book's introduction:

Your Sweat Equity:

This author has never lost money on any house he has built. This was true even during a major housing downturn in Colorado through the late 1980’s and again in western Tennessee through the early 1990’s and another downturn there in 2004. The foresight not to build beginning in 2006 saved losing on any construction in the major housing downturn at that time. The only time money was lost on any home was after buying one built by others in 2005, in Florida, just prior to the government caused real estate bubble bursting in 2008.The residential real estate market collapse offered some temporary beneficial effects for the self-home builder. Materials and labor became cheaper and more available, weak builder competitors were weeded out of the marketplace, banks and lenders became stronger as their bad loans were diminished, lending practices became more conservative, and unhealthy rampant speculation began to be forced out of the industry. Interest rates were falling for mortgages, and this helped the housing affordability index.

These short-lived benefits briefly assisted the low-overhead homebuilder in prospering, since he was buying low, with less competition and more stability in the depressed housing sector. Subsequently your sweat equity cushion from building your own home will give you a margin of safety with any drop in housing prices, and a nice profit in normal times. Continued government meddling guarantees wild price swings.

The only year this writer used a CPA to do his taxes, in 1991, the accountant was amazed at how much the profit was on the houses sold that year. This was because much of the income was due to my own sweat equity expended during building. Had others been contracted to perform that subcontract work, the savings would not have materialized. Since that year this builder has used tax preparation software to self-complete business taxes, eliminating yet another direct cost.

There are designers, subcontractors, lawyers, Realtors, bankers, accountants and bookkeepers you must hire if you do not have the time or means to accomplish the work of each. The more of these expenses you want to avoid, the more knowledge you must have of each of these professions. It is possible to handle much of the work of each of these disciplines by yourself if you are willing to invest the time and effort to gain the education you will need. Working for Subs is the blueprint for that education. The more work you do yourself the more your [sweat] equity will increase in your new home.

No comments:

Post a Comment